What is the Deposits Account?

Apr 28, 2020 Types of Demand Deposit Accounts As of Sept. 16, 2019, the total amount of demand deposit accounts in the U.S. Was $1.42 trillion. This compares to $1.1 trillion five years ago and $395 billion 10.

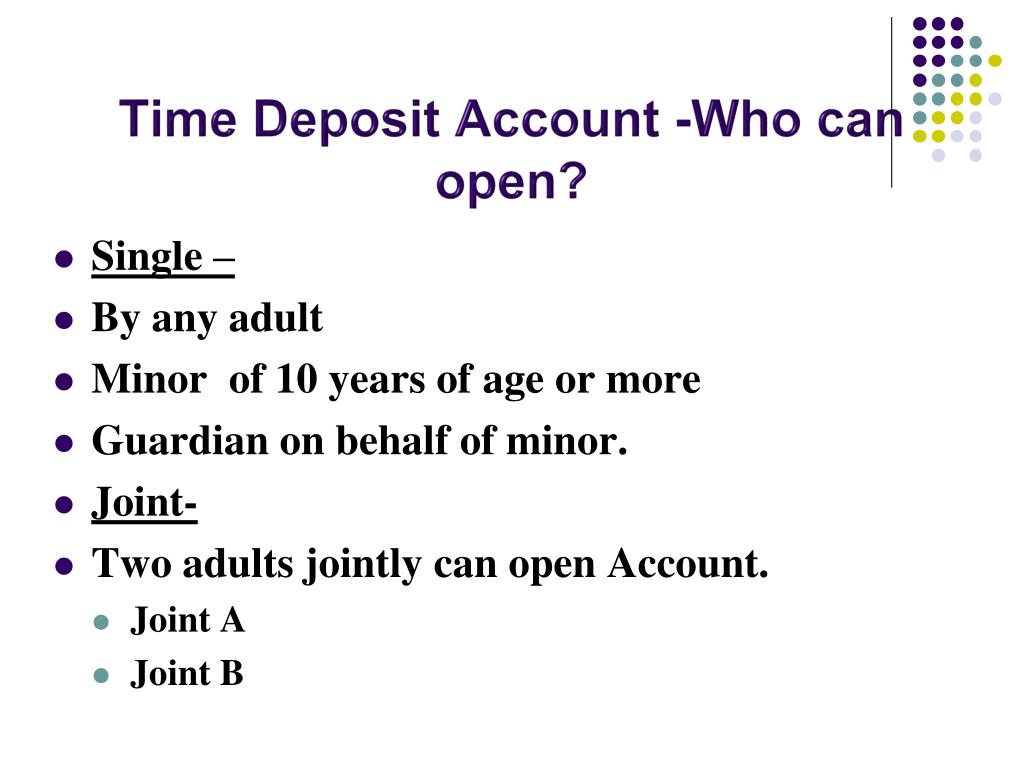

Time Deposits Cd

Deposits is a current liability account in the general ledger, in which is stored the amount of funds paid by customers in advance of a product or service delivery. These funds are essentially down payments. For example, a company may require a large deposit from a customer before it begins work on a highly customized product. Otherwise, the seller is at risk of loss if the customer cancels its order prior to delivery. When a customer payment is instead treated as a security deposit, the account may instead be named security deposits, in order to more clearly differentiate the nature of the liability.

Fixed Deposit Account. Some bank customers may like to put away money for a longer time. Such deposits offer a higher interest rate. If money is deposited in a savings bank account, banks allow a lower rate of interest. Therefore, money is deposited in a fixed deposit account to earn interest at a higher rate. A deposit account is a bank account maintained by a financial institution in which a customer can deposit and withdraw money.Deposit accounts can be savings accounts, current accounts or any of several other types of accounts explained below.

Related Courses

Also found in: Dictionary, Thesaurus, Legal, Acronyms, Encyclopedia, Wikipedia.

Bank Account

deposit account

see COMMERCIAL BANK.deposit account

Deposit Accounting

ortime account

orsavings account

an individual's or company's account at a COMMERCIAL BANK into which the customer can deposit cash or cheques and from which he or she can draw out money subject to giving notice to the bank. Deposit accounts (unlike CURRENT ACCOUNTS, which are used to finance day-to-day transactions) are mainly held as a form of personal and corporate SAVING and used to finance irregular ‘one-off payments.

an individual's or company's account at a COMMERCIAL BANK into which the customer can deposit cash or cheques and from which he or she can draw out money subject to giving notice to the bank. Deposit accounts (unlike CURRENT ACCOUNTS, which are used to finance day-to-day transactions) are mainly held as a form of personal and corporate SAVING and used to finance irregular ‘one-off payments.Want to thank TFD for its existence? Tell a friend about us, add a link to this page, or visit the webmaster's page for free fun content.

Link to this page: